jnsgioia

-

Posts

357 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Gallery

Downloads

Articles

Store

Blogs

Posts posted by jnsgioia

-

-

But you need to make sure that you don't have to charge sales tax to customers in your home state even if it is shipped from somewhere else. If you do then you need a combination rule for your state and the supplier's state. If you don't then you don't need combination rules.

-

The combined rule is for charging tax on an item to customers in more than one state.

How it works is for the items that are shipped from California you will need to have a combination rule for California and your state. You have to charge sales tax for anything purchased from you by someone in your state no matter where it is shipped from because you are receiving their money. (You may want to check with your state department of revenue to verify that but that is the rule in Kentucky, Wyoming, and Arizona where we have had businesses.) I am supposing that you have to pay your supplier the sales tax for items shipped to customers in California so you need to pass that on to the buyer (YOU are not required to file California sales tax). The tax rules are attached to items and because you can only have one rule attached to an item you will need to have a combination rule to charge tax in more than one state for that item. That is probably clear as mud...

-

You can only have one tax rule attached to an item so if you need to charge tax for an item in more than one state you will need to combine the states into one rule. I don't know if that is clear or not... :|

-

@traumflug I am not sure what you mean here.

The way it is now works for me. The state taxes are set up and you just have to add them to your new rule. It will be different for everyone. In the US we have to charge tax only for the state in which you are located. For me that is Arizona for everything and California and North Carolina for some items which I have dropshipped from those sates.

-

@alwayspaws I'm sorry it has taken me solong to respond. We are having some crazy busy days...

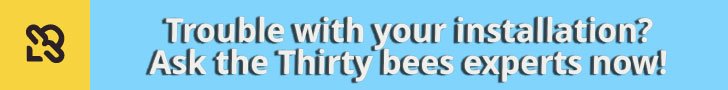

When you are on the edit page of your combined rule you need to add the states one at a time. That is click the "add new rule" button, add the state, save, then repeat for however many states you have. My combined rule page looks like this:

-

@alwayspaws I think you need to add one and then add the second one.

-

I created a new tax rule which has all three of those states and their taxes attached.

-

The column is Tax Rules ID and the field is Tax Rule ID. The value will be a number. I use 3 for Arizona and 53 for my combination rule.

Happy Thanksgiving!

-

You need to enable whichever states you have to collect tax for under the Localization-Taxes tab (make sure they have the correct tax listed, and edit it if it is wrong) and save. Then go to Localization-Tax Rules. If you only need South Carolina enable rule #40 and save. If you need more than one state you will have to create a new tax rule. Name it something you will remember save and then fill in the next bunch of fields, save. Once you have your tax rules set up you need to attach the rule to the products. I do this with my csv import.

-

@alwayspaws I don't think that is going to happen anytime soon. The paperwork to remit the taxes to each state as it is now would be a huge headache! They will probably come up with some kind of internet tax though.

-

@alwayspaws Do you have to charge sales tax for every state?

I only have to charge sales tax for items shipped to Arizona (which is my nexus) and, for some products, California and North Carolina (which is the nexus of a supplier which ships directly to the customer for me). To do this I have two tax rules, one for the things I ship directly with just Arizona customers paying the tax, and the other with Arizona, California and North Carolina customers paying tax.

If you have to charge sales tax for all states you will have to enable all of them in taxes and then create a new tax rule which includes all of them. You can only have one tax rule attached to a product.

-

@mdekker Both are now set up. Thank you very much for your help!

-

Thank you @mdekker. Until I watched your video I did not see the tiny white arrow on the help screen. Before I always just clicked the link and then got lost. I now have it working for LJsBooks.com. Am I right to assume I need to repeat the process for the second shop in my multishop setup?

-

Click the green button on the top right and choose the download zip option. (You can't just download the mails folder as far as I could see.) After it downloads unzip it and then upload just the mails folder to your server (I used filezilla).

-

@alwayspaws Glad to help :)

-

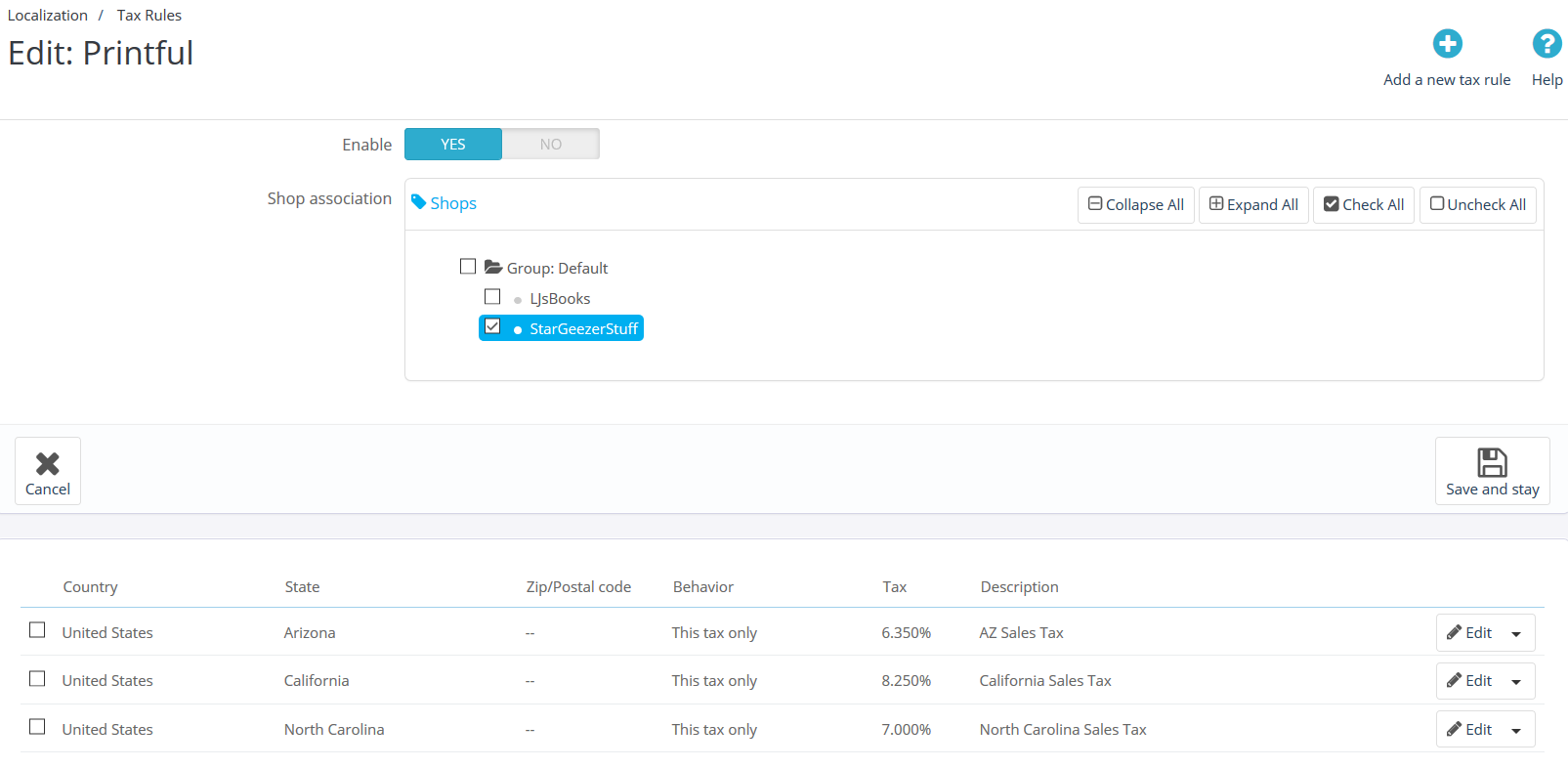

@alwayspaws Are the colors in the right position on this page?

-

If you are starting from scratch I would recommend having a database with your inventory and uploading to ThirtyBees using the csv import. There are several book databases available, BookTrakker.com is probably one of the best but has a monthly subscription fee. Bibliopolis.com has a product called Bookhound that can be purchased outright. Abebooks.com has a free product called HomeBase. Or if you, like me, are a glutton for punishment you can build your own using MS Access or FilemakerPro :)

As far as adapting 30bz, I use the product name for the title and all the other bibliographic items, author, publisher, date etc are features. The short description lists all the bibliographic information and basic condition of the book and DJ. The long description has the expanded condition. You can see how it plays out in the front office at LJsBooks.com. I tried using layered navigation but with the number of different authors, publishers and all it just didn't work. I disabled the add to cart buttons on the products featured on the home page and on the category pages because I want people to read the condition description before they purchase the book.

I hope that helps, if you have any questions please feel free to ask.

-

Works on the default theme as well. I put it in Preferences - Custom Code - add extra css to your pages.

-

I don't know anything about the payment module.

I do know about books and uploading them. I have a couple of questions. First, do you have the books in a database already or are you starting from scratch? Looking at that module it seems that you will have to manually update each product with the ISBN in the back office to populate the information.

Will you be selling new or used books and are you selling on any of the big venues as well?

-

Just an fyi -

The free module Custom popup notification, by PrestaCraft.com, works on 30bz.

-

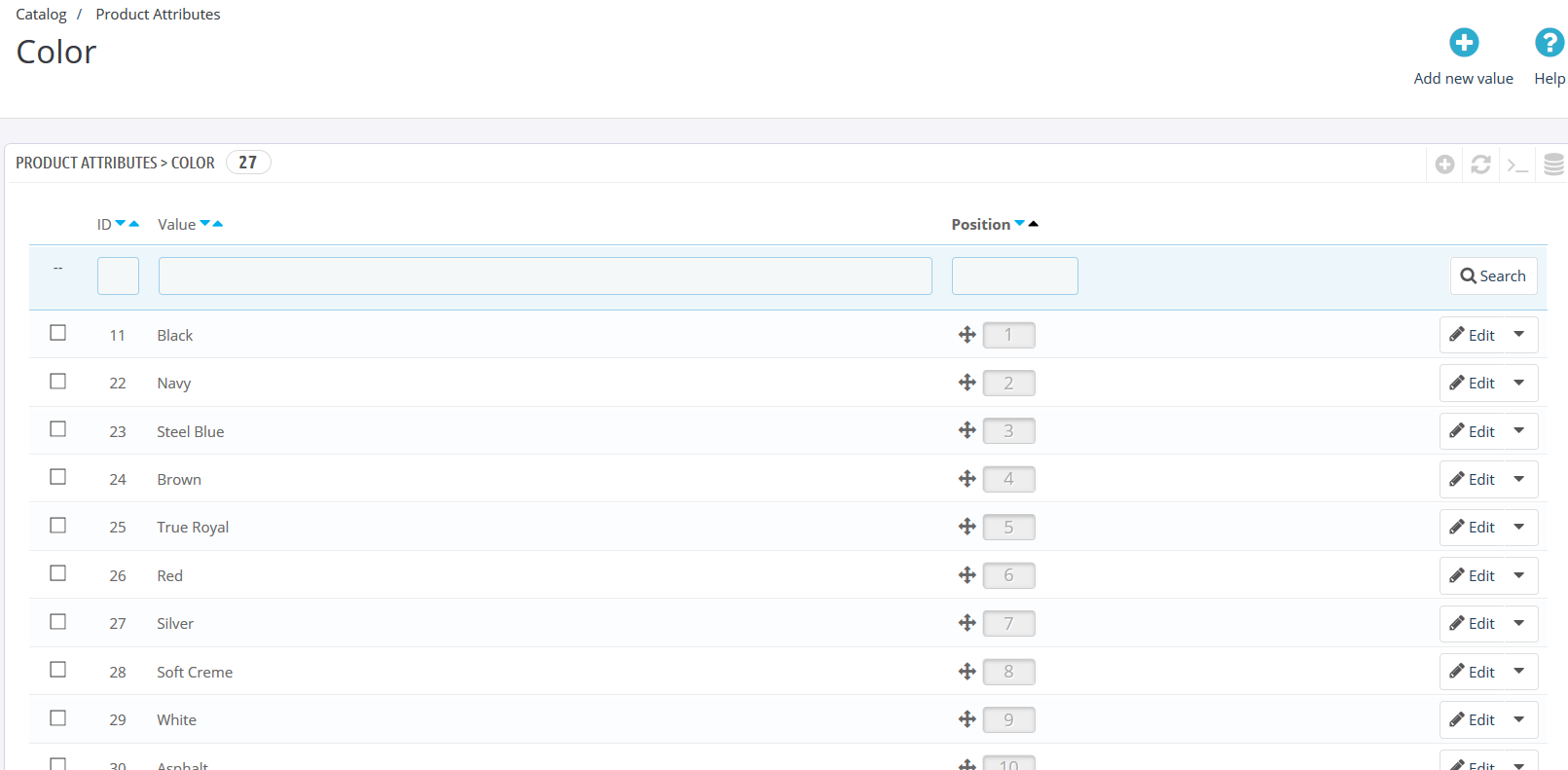

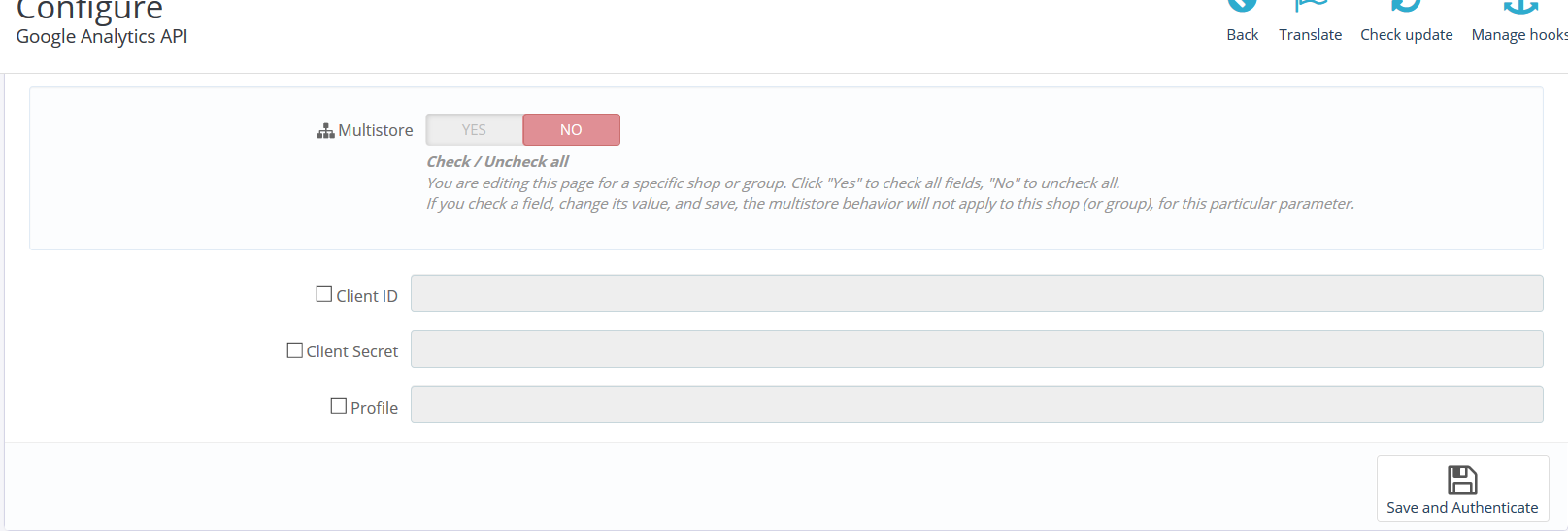

@mdekker Yes, I clicked through on that and got as far as the below page, but don't know where to go from there and could not find any help page to explain it.

-

Could some one explain, or point me to a good how to document, where I need to go to get the information to put in these boxes.

Thank you

-

Can you use BeyondCompare or something similar to compare the header.tpl from the two themes and see what needs to be changed?

-

I got that error one time a couple of days ago. I went to the update module, scrolled all the way to the bottom, clicked the update modules button and that seemed to fix the problem.

Happy

in English

Posted

Merry Christmas and Happy New Year to all!!