30knees

Trusted Members-

Posts

1,472 -

Joined

-

Last visited

-

Days Won

42

Content Type

Profiles

Forums

Gallery

Downloads

Articles

Store

Blogs

Everything posted by 30knees

-

That's a blessing, thank you!

-

@Mediacom87Thanks, I thought you had replied to my last question about the export. :-) That clears things up. Yes, documentation requires a lot of time. Good luck with that! I hope your module can export according to multiple order statuses, too. I'd be very interested in that. Thank you, @datakick. Unfortunately, it didn't work for me, even though I've tried altogether for about 2-3 hours, but it's OK. I'll find another solution. For others who want to try, some hints: With these collections: Ordered products Orders Addresses I could get these columns: Unit price Unit price tax excl. Country ID Invoice number Invoice date Is validated But that still means you have to manually associate the country ID with the country (not sure how that works where invoice and shipping addresses are different) the tax for the shipping costs is missing

-

@Mediacom87Understood. But without your module your post isn't very helpful for someone who is looking to export the amounts of VAT. :) Then I guess it's back to @datakickto hopefully help with his module, which I already have (see above), if @Mediacom87isn't selling his module (yet).

-

Thanks! If I understand the translation, you have a module that isn't available but that you might be willing to make available? This is the translation (note: I saw the shop setup requirements and I believe my tb is properly configured):

-

Yep, that's us. :) Thanks for the update.

-

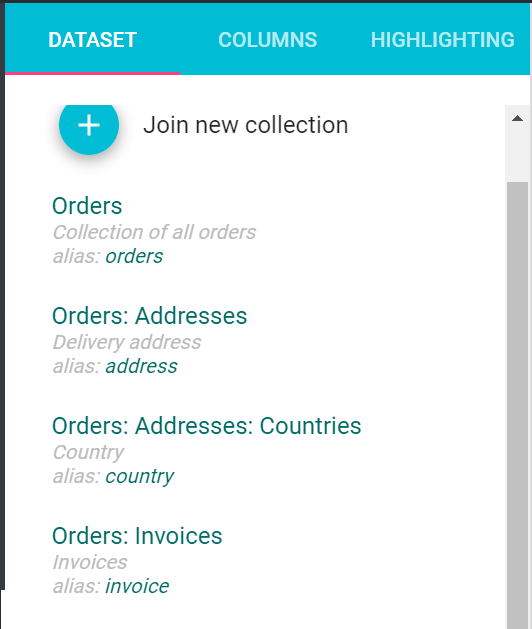

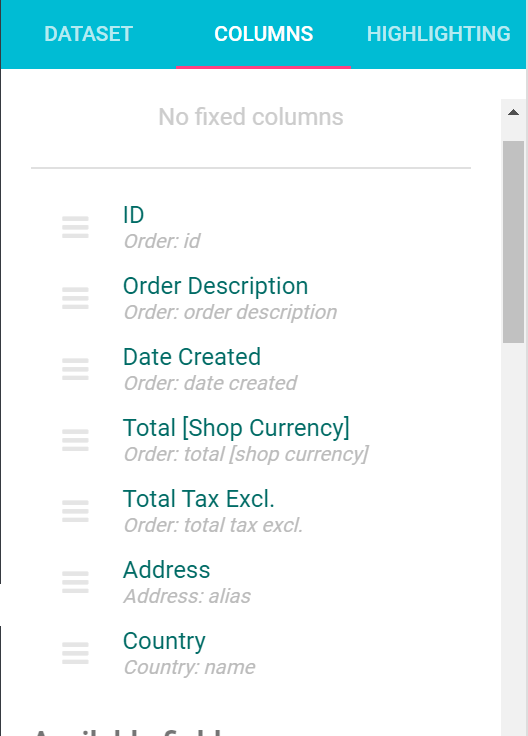

Thank you! I'm not succeeding with that, either, though. I'm not succeeding in getting the tax rate breakdown. This is what I have right now: and What am I missing?

-

What tools do you all use to get an overview of the VAT sums per VAT rate per Member State for the tax reporting? I'm struggling with that right now. I'm hoping Prestools will be able to do this:

-

I'd like to use the EU Order Tax feature to comply with the One Stop Shop VAT requirements. However, the One Stop Shop requires the sums per tax rate, so eg for Belgium 100 Euro for reduced 6%, 20 Euro for reduced 12%, and 40 Euro for standard 21%. Is there a way to do this?

-

That sounds great. I could imagine quite a few here would buy your theme. :D

-

Has anyone gotten Google Pay or Apple Pay to show in Chex with the official (not tb) Stripe module? They don't show for me. The module developers say: I'm guessing for now that there's an incompatibility but I'd like to ask for your experience. :)

-

The involic module is working now. Remaining issues that will be addressed in a future update: - more EU marketplaces (hopefully) - proper order method mapping

-

@BeetaIs your order tracking information being sent to Amazon with the involic module? Mine isn't. Edit 1: I also see now why the error was thrown. Orders don't have shipment information (price, weight, method) assigned to them when they're imported. That may have been because I didn't define a method (as proper shipment method mapping isn't supported yet). I've now defined a method and let's see. I'll update here.

-

I'm also using the involic one now. Setup was quick and easy. A couple of problems (I've contacted involic but they've not replied yet): It imported a bunch of old orders even though they had the status 'shipped'. It seems to have been a one-time thing. The orders that get imported throw an exception when I try to generate DHL shipments from them. I think some order status is missing from some tables: the orders also aren't being picked up by my warehouse order pick module, which relies on the order status. This is the error: Property OrderCarrier->id_order is empty in file classes/ObjectModel.php at line 1095 Source file: classes/ObjectModel.php 1076: * @throws PrestaShopException 1077: * 1078: * @since 1.0.0 1079: * @version 1.0.0 Initial version 1080: */ 1081: public function validateFields($die = true, $errorReturn = false) 1082: { 1083: foreach ($this->def['fields'] as $field => $data) { 1084: if (!empty($data['lang'])) { 1085: continue; 1086: } 1087: 1088: if (is_array($this->update_fields) && empty($this->update_fields[$field]) && isset($this->def['fields'][$field]['shop']) && $this->def['fields'][$field]['shop']) { 1089: continue; 1090: } 1091: 1092: $message = $this->validateField($field, $this->$field); 1093: if ($message !== true) { 1094: if ($die) { 1095: throw new PrestaShopException($message); 1096: } 1097: 1098: return $errorReturn ? $message : false; 1099: } 1100: } 1101: 1102: return true; 1103: } 1104: 1105: /**

-

No work around, unfortunately. It's the way the module connects to Amazon. That method isn't supported anymore.

-

Has anybody else's Amazon Marketplace module stopped importing orders because of MWS deprecation and the module not being updated anymore? My Prestalia module is now non-functioning because of that. The error I get is: {"status":"Developer is blocked from making calls for the MWS section Orders as part of MWS Deprecation process"} Any recommendations for an Amazon Marktplace module that still works with thirtybees?

-

Currently, it looks like @Smileand @datakickwill maintain the software. But you're on your own for any further requirements that aren't in the core. If you develop yourself and are happy to develop/maintain modules, you're probably good with tb. If you need external help with modules and what the core offers isn't sufficient, you may be better of looking elsewhere.

-

I searched for "shop software omnibus directive" and found: https://codecanyon.net/item/omniprice-prestashop-omnibus-directive-compatibility-module/37331365 (might even work with tb, it's PS 1.6 compatible! I'll check it out.) https://www.zemeilleur.com/omniprice-module-de-compatibilite-prestashop-omnibus-directive/ https://cl.wordpress.org/plugins/omnibus-for-woocommerce/ https://www.wpdesk.net/products/wp-desk-omnibus/

-

I'm also curious. I just did a quick search and found plugins for WooCommerce and Prestashop. Shopware was blogged about it, so I'd assume (hope) they support it. I'm curious how Shopify will deal with this. I guess we'll see more and more support in the next days and weeks. I'll post if I stumble across anything.

-

Not every page gets fined, of course. (And note: You don't need a cookie banner if the cookies are technically necessary. There's also not too much that is "GDPR" required that's customer facing beyond a proper privacy policy.) Here's information on the Abmahnung: https://en.wikipedia.org/wiki/Abmahnung

-

No, it's not clearly designed for brick and mortar shops. A number of the recitals indicate the digital nature, such as this one: That being said, I think it's very dangerous and not very conducive for thirtybees's success in the EU to ignore legal requirements because they're difficult to implement. I do appreciate the technical challenge you face and I also very much see that such legislation makes it harder for smaller providers like thirtybees to succeed. Still, merchants have to comply with the law.